GREETINGS FROM

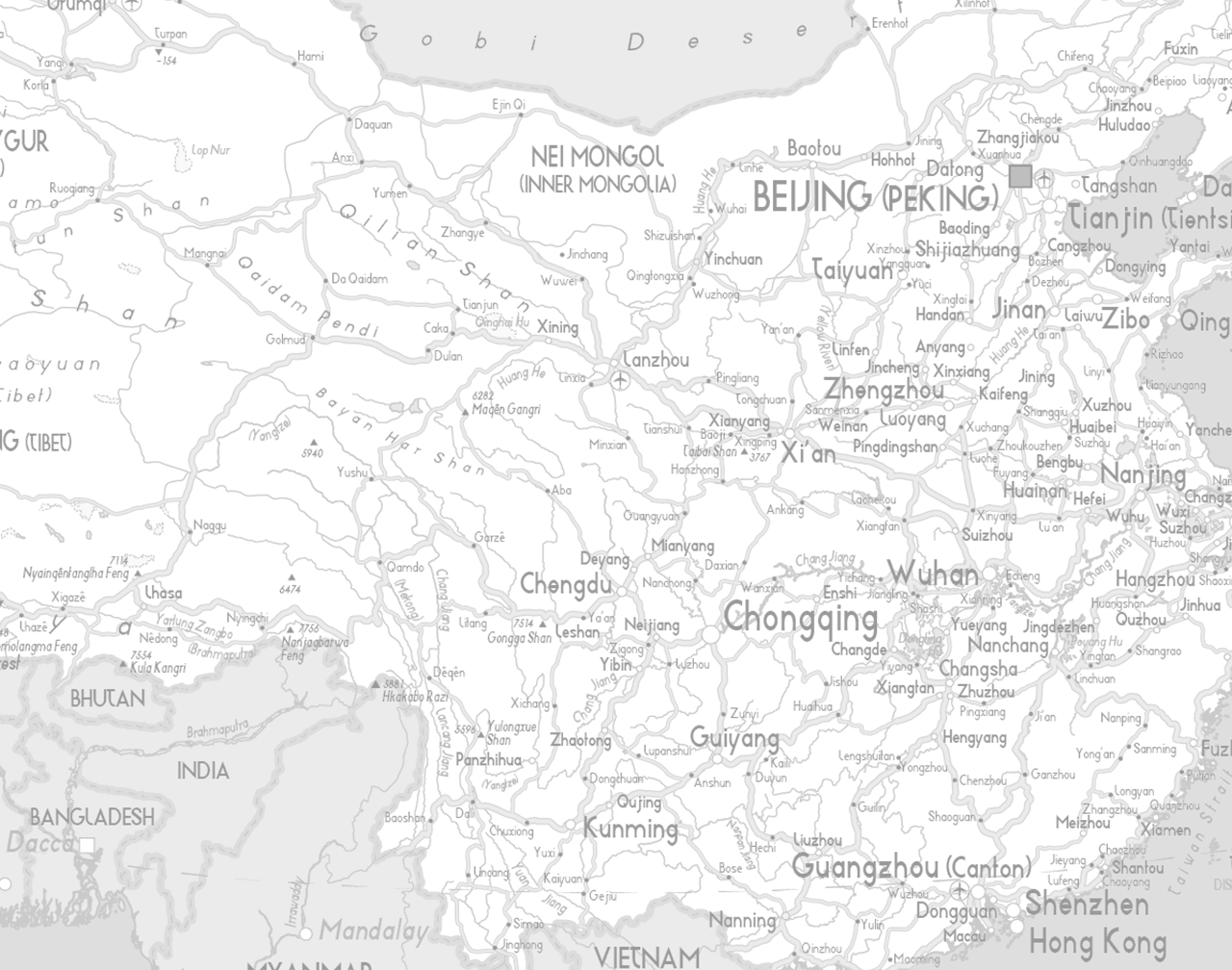

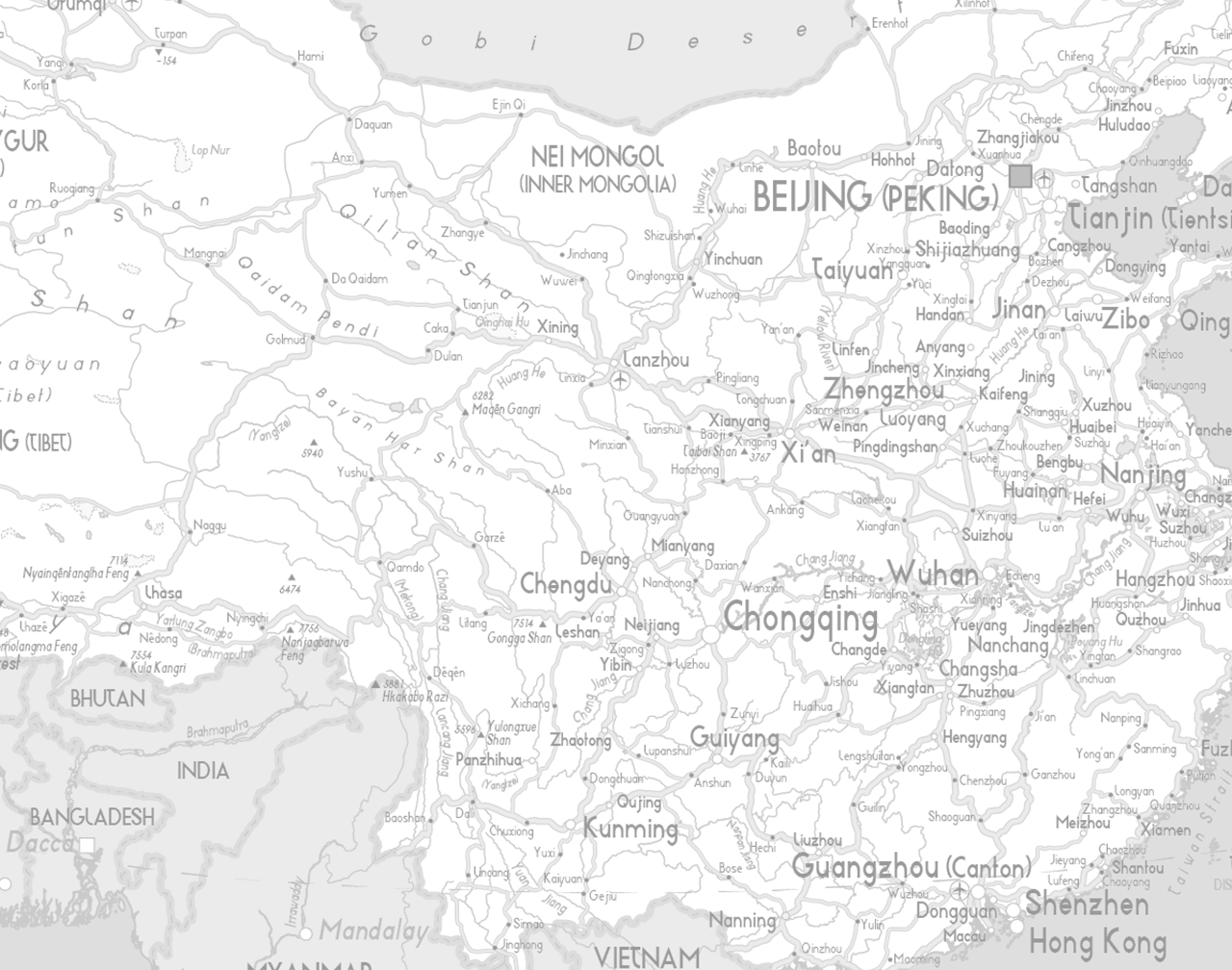

Lely China, based in Qingdao, is the most recent center to open in Asia (May 2019). In China there are approximately 4,000 dairy farms, each with a minimum of 500 cows. This represents enormous potential for Lely. Lely China is currently mostly focused on Dairy XL farms, each with more than eight milking robots. China’s Lely team currently comprises six employees, including a national manager, TSS, FMS and marketing personel.

In relation to China’s size and population, it has a relatively low level of dairy production and is home to around five million dairy cows. The government is planning to increase the country’s milk production by 40% before the end of 2025.

China’s sales are made through two dealers and Lely China carries out services on behalf of these dealers. Robotic milking is new to the Chinese market. There are still fewer than 80 milking robots in the whole country, so fewer than 0.01% of cows are milked by robots.

Lely has installed two milking robots in Weifang and another 12 will follow in May 2021. And China’s first Lely Center should be up and running in June/July 2021. Based in Shijiazhuang, it will be where Lely sold its first Dairy XL project. This project is a collaboration with Junlebao, which is the third largest dairy group in China. It is also the country’s leading producer of milk powder, which is still the biggest dairy product in China.

Life at the Cluster

- Average milk yield: 25kg per cow per day

- Well-managed large herds are averaging between 30kg and 33kg per cow per day

- 2,300 dairy farms have more than 500 dairy cows

- 1,400 dairy farms have more than 1,000 dairy cows

- 200 of dairy farms have more than 5,000 cows

Enormous potential

China facts

Compared to rotary milking systems, robotic milking cost three or four times more and the return on investment (ROI) is between five and six years. The Chinese typically expect a ROI of between two or three years.

Chinese culture is based on tradition and there is an aversion to making mistakes, so encouraging people to be the first to try new technology can be difficult. Other farmers prefer to wait and see the results from other dairy farms, before they feel ready to embrace the technology.

China’s vast size is another challenge. Travelling to potential customers can take up 10 hours, and when employees arrive they can find that the customer has postponed or even cancelled the meeting. And the distance is also a challenge when providing services or sending spare parts to these farms.

China offers Lely a wealth of opportunities and possibilities. There is a lot of interest in our products and, when we’ve overcome the myriad of challenges we’ve outlined, Lely believes it has a bright future in China.

Our goal is to sell enough installations in China to justify setting up three or four Lely Centers by the end of 2022. We would like to be the robotic milking market leader in China by the end of 2023.

We are positive that when we get the Junleabao (12 milking robot) project up and running – and prove that Lely robots are the best choice for farmers – we will see a rapid increase in take up in China.

Future goals

GREETINGS FROM

Lely China, based in Qingdao, is the most recent center to open in Asia (May 2019). In China there are approximately 4,000 dairy farms, each with a minimum of 500 cows. This represents enormous potential for Lely. Lely China is currently mostly focused on Dairy XL farms, each with more than eight milking robots. China’s Lely team currently comprises six employees, including a national manager, TSS, FMS and marketing personel.

In relation to China’s size and population, it has a relatively low level of dairy production and is home to around five million dairy cows. The government is planning to increase the country’s milk production by 40% before the end of 2025.

China’s sales are made through two dealers and Lely China carries out services on behalf of these dealers. Robotic milking is new to the Chinese market. There are still fewer than 80 milking robots in the whole country, so fewer than 0.01% of cows are milked by robots.

Lely has installed two milking robots in Weifang and another 12 will follow in May 2021. And China’s first Lely Center should be up and running in June/July 2021. Based in Shijiazhuang, it will be where Lely sold its first Dairy XL project. This project is a collaboration with Junlebao, which is the third largest dairy group in China. It is also the country’s leading producer of milk powder, which is still the biggest dairy product in China.

Life at the Cluster

- Average milk yield: 25kg per cow per day

- Well-managed large herds are averaging between 30kg and 33kg per cow per day

- 2,300 dairy farms have more than

500 dairy cows - 1,400 dairy farms have more than

1,000 dairy cows - 200 of dairy farms have more than

5,000 cows

Enormous potential

China facts

Compared to rotary milking systems, robotic milking cost three or four times more and the return on investment (ROI) is between five and six years. The Chinese typically expect a ROI of between two or three years.

Chinese culture is based on tradition and there is an aversion to making mistakes, so encouraging people to be the first to try new technology can be difficult. Other farmers prefer to wait and see the results from other dairy farms, before they feel ready to embrace the technology.

China’s vast size is another challenge. Travelling to potential customers can take up 10 hours, and when employees arrive they can find that the customer has postponed or even cancelled the meeting. And the distance is also a challenge when providing services or sending spare parts to these farms.

China offers Lely a wealth of opportunities and possibilities. There is a lot of interest in our products and, when we’ve overcome the myriad of challenges we’ve outlined, Lely believes it has a bright future in China.

Our goal is to sell enough installations in China to justify setting up three or four Lely Centers by the end of 2022. We would like to be the robotic milking market leader in China by the end of 2023.

We are positive that when we get the Junleabao (12 milking robot) project up and running – and prove that Lely robots are the best choice for farmers – we will see a rapid increase in take up in China.

Future goals